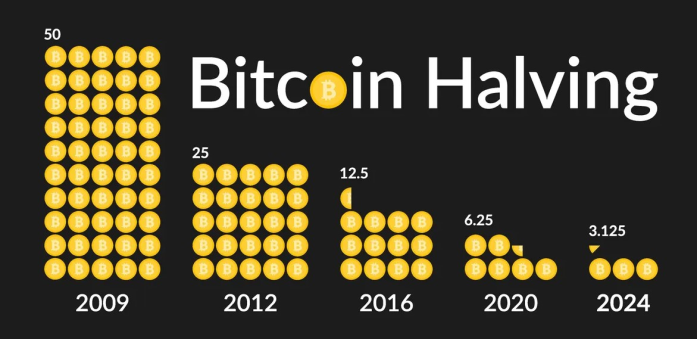

The Bitcoin 4-year market cycle is a topic of much debate and speculation within the cryptocurrency community. Some believe that this cycle, characterized by significant price movements every four years, is a real phenomenon based on historical data and patterns. The theory suggests that Bitcoin experiences a bull market followed by a bear market approximately every four years, typically tied to the halving event where the block reward for miners is reduced by half. This pattern has been observed in previous cycles, with notable price increases leading up to each halving event.

However, skeptics argue that the notion of a predictable 4-year market cycle for Bitcoin is purely coincidental and not grounded in any solid economic or technical analysis. They point out that the cryptocurrency market is highly volatile and influenced by numerous external factors beyond just supply dynamics. Market sentiment, regulatory changes, macroeconomic events, and technological developments all play a role in shaping Bitcoin's price movements, making it difficult to rely solely on past patterns to predict future outcomes. Additionally, critics highlight instances where the cycle did not hold true or was disrupted by unexpected events.

In conclusion, whether or not the Bitcoin 4-year market cycle is real remains uncertain and open to interpretation. While there are compelling arguments on both sides of the debate, it's essential for investors and enthusiasts to approach such theories with caution and consider multiple factors when analyzing cryptocurrency markets. Regardless of one's stance on the matter, it's clear that Bitcoin's price behavior will continue to be subject to various influences as it evolves in an ever-changing financial landscape.

Yes, the Bitcoin 4-Year Market Cycle is a real phenomenon that has been observed multiple times in the history of Bitcoin. This cycle refers to the pattern where every four years, the reward for mining new Bitcoins is halved, leading to a decrease in supply. This reduction in supply tends to drive up demand and subsequently increase the price of Bitcoin. As a result, we often see periods of significant growth and bull markets followed by corrections and bear markets within this four-year cycle.

While past performance is not indicative of future results, many investors and analysts closely monitor this cycle as they believe it can provide insights into potential price movements of Bitcoin. However, it's important to note that market cycles are influenced by various factors and may not always play out exactly as expected. Nonetheless, understanding the Bitcoin 4-Year Market Cycle can be valuable for those looking to make informed decisions when investing in or trading Bitcoin.

Overview of Bitcoin market cycles.

Yes, the Bitcoin 4-year market cycle is a real phenomenon that has been observed since the inception of Bitcoin. This cycle is based on the halving event that occurs approximately every four years, where the block reward for miners is reduced by half. Historically, this event has led to increased scarcity of Bitcoin and has often been followed by a bull market as demand outstrips supply.

During these market cycles, Bitcoin's price tends to go through periods of significant growth followed by corrections and consolidation phases. While past performance is not indicative of future results, many analysts and investors closely monitor these cycles as they can provide insights into potential price movements and trends in the cryptocurrency market.

Overall, understanding the Bitcoin 4-year market cycle can be valuable for investors looking to capitalize on potential opportunities and navigate the volatility inherent in the cryptocurrency space. By studying historical data and market patterns, individuals can make more informed decisions when it comes to buying, selling, or holding onto their Bitcoin investments.

The Bitcoin market is known for its unpredictable and often volatile nature, characterized by various cycles of booms and busts. These market cycles typically follow a pattern where the price of Bitcoin experiences sharp increases (bull markets) followed by steep declines (bear markets). During bull markets, there is a heightened sense of euphoria among investors as they witness their investments grow rapidly in value. This is often fueled by positive news, adoption by institutional investors, and overall bullish sentiment in the market.

However, these periods of growth are usually followed by sharp corrections as the market cools off and profit-taking occurs. Bear markets are marked by fear, uncertainty, and panic selling as prices plummet, leading to widespread losses for many investors. The duration of these cycles can vary significantly, with some lasting months while others may extend over several years. Despite the volatility and risks associated with Bitcoin market cycles, many long-term hodlers remain optimistic about the future potential of this digital asset as a store of value and hedge against inflation.

In conclusion, understanding Bitcoin market cycles is crucial for anyone looking to invest or trade in cryptocurrencies. Recognizing when to enter or exit the market based on these patterns can help mitigate risks and maximize returns. While it's impossible to predict with certainty how the next cycle will unfold, historical data suggests that these boom-and-bust cycles are an inherent part of the cryptocurrency ecosystem. By staying informed about industry trends, regulatory developments, and macroeconomic factors influencing Bitcoin's price movements, individuals can navigate these cycles more effectively and make informed decisions about their investment strategies.

History: Previous 4-year cycle patterns.

Bitcoin market cycles have become a defining characteristic of the cryptocurrency's history, with distinct patterns emerging every four years. The first major cycle began in 2012 when Bitcoin experienced its first halving event, reducing the mining rewards by half. This triggered a bull run that saw the price surge to new heights before experiencing a significant correction. The subsequent cycle in 2016 followed a similar pattern, with Bitcoin reaching new all-time highs after the second halving event and then facing another sharp decline.

As we approach the next halving event scheduled for 2020, analysts and investors are closely watching to see if history will repeat itself once again. The previous two cycles have shown that Bitcoin tends to follow a predictable pattern of growth and decline, driven by supply dynamics and market sentiment. While past performance is not indicative of future results, many believe that studying these historical cycles can provide valuable insights into how Bitcoin may behave in the coming years. Whether we will witness another bull run or a prolonged period of consolidation remains uncertain, but one thing is clear: understanding these market cycles is essential for navigating the volatile world of cryptocurrency investing.

Bitcoin market cycles have historically followed a pattern known as the 4-year cycle, driven by the halving events that occur roughly every four years. These cycles typically begin with a period of accumulation, followed by a sharp increase in price leading to a bull market phase. This is then followed by a correction and consolidation phase before starting the cycle again.

The most recent 4-year cycle for Bitcoin began with the halving event in 2020, which was followed by a significant increase in price throughout 2021. As we enter 2022, many analysts are predicting that we are currently in a consolidation phase before another potential bull run in the coming years. Understanding these historical patterns can help investors make more informed decisions about when to buy or sell their Bitcoin holdings.

It's important to note that while past performance is not indicative of future results, studying previous market cycles can provide valuable insights into potential trends and behaviors within the cryptocurrency space. As always, it's crucial for investors to conduct their own research and due diligence before making any investment decisions in this highly volatile market.

Analysis: Data supporting market cycle theory.

Bitcoin market cycles have been a topic of much discussion among analysts and investors in the cryptocurrency space. The market cycle theory suggests that Bitcoin's price movements follow a cyclical pattern, with periods of rapid growth followed by corrections and consolidation. Data analysis has shown that historical trends support this theory, with Bitcoin experiencing several boom and bust cycles over the years.

One key indicator supporting the market cycle theory is the halving event that occurs approximately every four years. This event reduces the rate at which new Bitcoins are created, leading to a decrease in supply. Historically, these halving events have been followed by significant price increases as demand outpaces supply. Additionally, technical analysis of Bitcoin's price charts has revealed patterns such as Elliott Waves and Fibonacci retracements that align with the concept of market cycles.

Overall, while past performance is not indicative of future results, the data supporting Bitcoin market cycles provides valuable insights for investors looking to understand and predict price movements in the cryptocurrency market. By analyzing historical trends and applying technical analysis tools, investors can gain a better understanding of how Bitcoin's price may evolve in future market cycles.

Bitcoin market cycles have become a topic of great interest and debate among investors and analysts. The data supporting the existence of market cycles in Bitcoin is robust and compelling. By analyzing historical price movements, patterns emerge that suggest distinct phases of growth, consolidation, and correction. These cycles tend to repeat themselves over time, creating opportunities for traders to anticipate future trends based on past performance.

One key aspect of Bitcoin market cycle analysis is the concept of accumulation and distribution phases. During the accumulation phase, savvy investors accumulate Bitcoin at lower prices before a significant rally occurs. This phase is often characterized by low trading volume and sideways price movement. On the other hand, the distribution phase occurs when prices are high, and early investors start selling their holdings to take profits. By identifying these phases in historical data, traders can make more informed decisions about when to buy or sell their assets.

In addition to accumulation and distribution phases, technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can also be used to support market cycle theory analysis. These indicators help identify overbought or oversold conditions in the market, providing further evidence of cyclic behavior in Bitcoin price movements. By combining historical data with technical analysis tools, investors can gain valuable insights into potential turning points in the market cycle and adjust their trading strategies accordingly for better risk management and profitability.

Criticisms: Challenges to the theory's validity.

Bitcoin market cycles have been a topic of much fascination and analysis among investors and analysts alike. The theory suggests that the price of Bitcoin goes through repetitive patterns of growth, peak, decline, and accumulation before starting the cycle all over again. This cyclical nature has led many traders to use historical data to predict future price movements and make informed investment decisions. However, there are criticisms regarding the validity of this theory that challenge its reliability in predicting Bitcoin's market behavior.

One major criticism is the unpredictable nature of external factors that can influence Bitcoin prices, such as regulatory changes, technological advancements, or market sentiment. These externalities can disrupt traditional market cycles and lead to unexpected price fluctuations that may not align with historical patterns. Additionally, some argue that the increasing institutional interest in Bitcoin has changed the landscape of the market significantly, making it difficult to rely solely on past data for accurate predictions. As a result, critics suggest that while market cycles may provide useful insights into Bitcoin's price movements, they should not be treated as infallible indicators of future trends.

Despite these challenges to its validity, the concept of Bitcoin market cycles continues to be a popular framework for understanding price movements in the cryptocurrency space. Proponents argue that while external factors can certainly impact prices in the short term, long-term trends still tend to follow familiar patterns dictated by investor behavior and supply-demand dynamics. As such, it is crucial for investors to consider both historical data and current market conditions when analyzing Bitcoin's price movements rather than relying solely on cyclical theories for investment decisions.

Expert Opinions: Views from industry professionals.

Bitcoin market cycles have been a hot topic in the world of cryptocurrency, with industry professionals offering varied opinions on the matter. Some experts believe that Bitcoin follows predictable patterns, known as market cycles, where prices fluctuate between periods of growth and decline. These professionals argue that understanding these cycles can help investors make informed decisions about when to buy or sell their Bitcoin holdings.

On the other hand, there are industry professionals who caution against relying too heavily on market cycle predictions. They argue that the cryptocurrency market is highly volatile and influenced by a myriad of factors beyond simple cyclical patterns. These experts advise investors to conduct thorough research and consider multiple indicators before making any investment decisions related to Bitcoin.

Despite the differing views among industry professionals, one thing remains clear: Bitcoin market cycles continue to be a point of interest and debate within the cryptocurrency community. As more data is collected and analyzed over time, perhaps a clearer picture will emerge regarding the predictability and reliability of these cycles. In the meantime, it is essential for investors to remain vigilant, stay informed about market trends, and seek advice from reputable sources before navigating the ever-changing landscape of Bitcoin trading.

Future Outlook: Speculation on next cycle.

The Bitcoin market has been characterized by its cyclical nature, with periods of rapid growth followed by sharp corrections. This volatility has made it both appealing and challenging for investors looking to capitalize on the digital currency. As we look ahead to the future of Bitcoin market cycles, one cannot help but speculate on what the next cycle may bring. Will we see another meteoric rise in prices followed by a crash, or will the market stabilize and mature over time? These questions are at the forefront of many investors' minds as they try to navigate this ever-evolving landscape.

One possible scenario for the next Bitcoin market cycle is a more gradual increase in prices, driven by increased mainstream adoption and acceptance. As more institutions and individuals incorporate Bitcoin into their investment portfolios and daily transactions, this could create a more stable foundation for growth. Additionally, regulatory developments and technological advancements may play a significant role in shaping the trajectory of future cycles. It is also worth considering external factors such as global economic conditions and geopolitical events that could impact investor sentiment and ultimately influence the direction of Bitcoin prices.

However, it is important to remember that predicting market cycles with certainty is impossible due to the inherent unpredictability of financial markets. While historical data can provide some guidance, there are always unforeseen events that can disrupt established patterns. Therefore, investors should approach speculation on the next Bitcoin cycle with caution and diversify their investments accordingly to mitigate risks associated with volatile assets like cryptocurrencies.

Conclusion

In conclusion, while the Bitcoin 4-year market cycle has shown remarkable tendencies in the past, it's essential to approach it with caution and a critical eye. The cryptocurrency market is highly volatile and influenced by a myriad of factors beyond just historical patterns. Investors should consider fundamental analysis, market sentiment, regulatory changes, and global economic conditions alongside any cyclical theories.

Ultimately, the concept of the Bitcoin 4-year market cycle serves as a useful tool for understanding historical trends and potential future movements in the cryptocurrency space. However, it should not be solely relied upon for making investment decisions. Smart investors will take a holistic approach to analyzing the market, combining both technical analysis and fundamental research to make informed choices about their investments in this rapidly evolving landscape.